Andrew Granato here, guest writing on The Margins today. I last wrote on Margins about Robinhood and the Limits of Innovation. Today, we talk about sticking it to The Man by spending your hard-earned $$$ on publicly traded shares of video game stores.

The financial story of the moment is that GameStop, the video game store best known for stiffing you on your PS2 trade-in in 2007, is the hottest stock in America at least in large part because of the efforts of amateur retail investors who organized on Reddit’s /r/WallStreetBets forum. As the year began, GameStop traded at about $20 per share. As I write this it has peaked at $470 and is currently around $200, and it will probably be some completely different number by the time you read this. Why this is happening (in both a logistical and existential sense) is an object of mass fascination, and attempts to figure What The GameStop Rally Means have led various commentators on some, uh, journeys.

The most interesting of these ad hoc explanations to me is the view that the GameStop rally represents the vanguard of a financial revolt by the masses of everyday retail investors against financial elites, an “Occupy Wall Street with a huge army behind them invading the most sacred and secured spaces with great ease.” (See analogous thoughts here, here, etc). This is not so much because it is accurate (it’s not), but because the hollowness of the story might be a jumping off point for thinking more carefully about what finance can deliver.

tl;dr

This section will be a recap of some basics of financial markets and the GameStop story. If you have been following the story in detail, just skip to the next section.

Businesses need money in order to do elementary business things like make investments and grow, and they generally get that money by issuing debt or selling shares of themselves to investors. In publicly traded markets, basically anyone can buy and sell shares of companies like Company X. If you buy shares of X, you are buying a claim on the future cash flows (dividends) of those shares, as well as the company voting rights that the shares grant so that you will be able to do things like cast votes on shareholder resolutions and who will get to be on the company’s board of directors.

If people think that X will be a successful company that will pay out those expected big future profits in dividends, they will want to get in on this and buy shares of X, which will increase the price of the shares. If people think that X is going to not be a successful company and will not have much money to pay out to shareholders, they will buy it less, and the value of the shares will decline. If you want to make money on the stock market, you want to buy shares of companies whose share price will go up in the future, not down.

‘Shorting’ a stock is when you make a bet that a company’s share price will go down; here’s how it works. Let’s say company X trades at $10 per share and investor A believes that X’s share price will go down to $5 per share. A can borrow a share of X from investor B (so now A owes B a share of X within some time frame) and sell that share on the open market, so A gets $10 for selling that share. If A is right and X’s share price goes down to $5, A can buy a share of X on the open market for $5 and give that share back to B. A gained $10 from selling a share and paid $5 to buy a share in the same company, so A gains $10 - $5 = $5. If, however, the stock actually goes up to $20 a share and stays there, A will have to pay that $20 to buy the share back to give to B, and therefore A will lose $10 ($10 - $20 = -$10).

For a long time, people thought GameStop was not going to be very successful because it is a tough beat being a mostly physical video game retailer in this day and age. GameStop’s valuation had declined a great deal and it was a heavily shorted stock, so lots of investors were betting that its valuation would continue to fall.

However, some investors believed that GameStop was undervalued and that its share price would rise, such as entrepreneur and activist investor Ryan Cohen. Cohen was joined by a movement of almost entirely anonymous retail investors who committed to buying the company’s shares (or options to buy shares) on the /r/WallStreetBets subreddit. Since then, GameStop’s market capitalization has risen with such a fervor that Melvin Capital, a hedge fund that had taken a substantial short position on GameStop, gave up on the short after requiring a multibillion dollar capital infusion from other hedge funds just to stay afloat.

And that gets us to this proposal that the Reddit GameStop rally is a strike against the machinery of Wall Street.

The Massive Redistribution of Money from Some Rich People to Other Rich People

This story that retail investors buying GameStop shares constitutes populism relies on the fact that the most publicly visible reason for the stock surge is investors who are putting in small amounts of money by public equity markets standards (from the hundreds to the tens of thousands, if we choose to believe screenshots with thousands of upvotes on Reddit) while the most visible losers are two hedge funds, Melvin Capital and Citron Research.

Who is actually reaping the strong majority of the benefits of the surge, on the other hand, bears little resemblance to Reddit day traders and much more resemblance to Melvin and Citron, because the strong majority of equities in the United States are owned by wealthy individuals and asset managers who act on behalf of mostly wealthy individuals. Who are the biggest owners of GameStop? Fidelity (14%), Cohen’s RC Ventures (13%), and BlackRock (11%), and then a bunch of other mutual and hedge funds, and also a guy named Donald Foss who became a billionaire from a subprime auto loan company. Pick almost any American publicly traded company; the list of names will be pretty similar. And as Ranjan Roy wrote about yesterday for some newsletter, there is strong evidence that the rally itself is primarily driven by professional investors.

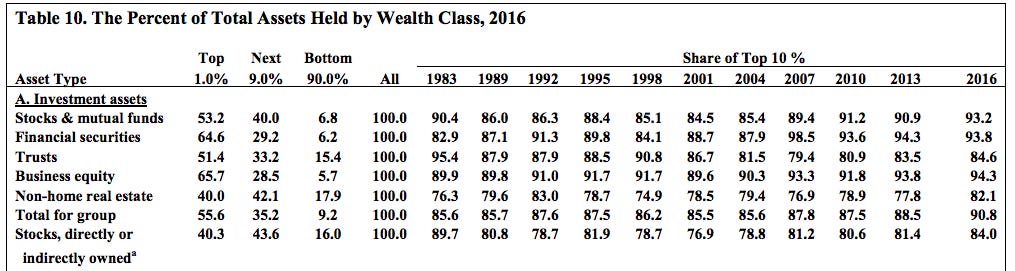

(Also, while the top 10% of the US in terms of wealth ownership own in the neighborhood of 90% of the value of all financial instruments and so they utterly dominate the gains of financial markets, the demographics of day traders also skew affluent for the uncomplicated reason that low-income people do not have spare hundreds or thousands of dollars for speculation, so the idea that the brigade is the masses deserves some qualification.)

As I’m writing this, several brokerages like Robinhood and TD Ameritrade have temporarily shut off access to buying GameStop and a few other highly volatile, heavily memed stocks for reasons. The brokerages have said that their clearing firms, because of the sharply increased volatility, needed additional collateral and ordered halts to trading, but these closings have prompted (edging on conspiratorial) speculation that massive hedge fund Citadel, which recently made an emergency investment in Melvin and whose market maker arm Citadel Securities pays for Robinhood trade orders to be directed to it, is improperly pressuring brokerages to stop the GameStop surge. If this turns out to be the case, it would be a major scandal, and is certainly worthy of regulatory scrutiny. Would this, if proven to be true, validate the GameStop rush as a Power To The People moment?

As Matthew Zeitlin notes, vague references to The Establishment of Big Finance could encompass mutual funds, investment banks, hedge funds, high frequency traders, private equity, or any number of other major players, all of whom play hardball. The easy part about constructing a populist narrative in that context is that since literally anything you do in a financial market will have a financially adverse interest to a counterparty somewhere with deep pockets, anything you do can be anti-establishment if you want to cast yourself as such. Simultaneously, anything you do is also a reification of the establishment if you want to frame it that way (no one wants to frame it that way).

This week, a few hedge funds are the establishment, but BlackRock is not, apparently. Anyone can play populist if they plug in the right-sounding language regardless of material consequences. So it goes.

Tommy and Gina, Livin’ on Margin

That the GameStop surge would attract tremendous attention makes sense! It’s fun to root for people who strike it rich overnight, and it’s straightforward why there is schadenfreude in watching some hedge funds - an industry notorious for pulling sleazy stunts and screwing with markets as a matter of course - get washed as a result. This is especially true when some of the people going on TV to complain about it are people like this guy. (It will be substantially less funny when the retail investors who bought in later because they were promised that this was their big chance to improve their financial situations see their investment crash and lose their savings, but that sort of personal narrative is less likely to get thousands of upvotes, so we might not have to look at that as much.)

It’s widely recognized at this point that any social activism gets immediately absorbed by self-serving financial interests that use that passion to cynically sell you stuff and tell you that buying is part and parcel of that activism. Here, there are people who even say up front that they are shareholders in GameStop pounding the pavement to broadcast that buying shares of GameStop is good because it will help deliver poetic justice, and some of the people who have been making careers out of warning against this exact thing think it’s great.

If much of Wall Street is taking your “we’re beating Wall Street” narrative and laughing all the way to the bank, you have overlooked something.

The GameStop rally doesn’t have legs as a leveling of money and power, but some people ran with it anyway because a couple of upfront facts in the story made it seem like the sort of thing that could be such a revolt if you squinted at it hard enough and didn’t think it through too much. I want better than that. I want better than trying to convince myself that people gambling their savings is an expression of democratic victory, or that the results of triumphant material change should be realized as an increase in the market capitalization of a half-dead retailer that is probably wondering right now if it would be kosher to sell off a ton of new shares and then do a massive share buyback after the price collapses.

Playing shell games with which major institutional investors and billionaires constitute the establishment and which don’t may be a dead end, but there are real proposals and real histories for harnessing finance for broad-based economic advancement! Labor unions have used their pension funds for activist corporate governance. National governments have created sovereign wealth funds that distribute returns to the public (Alaska does this every year!), and such a structure has the potential to significantly expand the notion of a public company’s responsibilities. We don’t have to lie to ourselves that bumping GameStop’s share price, any more than hawking subprime mortgages in 2006 on the purported grounds that it would make homeownership accessible, is the path forward.

Disclosure: I have a retirement account through Vanguard that is invested in public equity and bond indexes, so I am presumably an indirect investor in GameStop who in a minuscule way benefits from the GameStop rally. Hurray.

Editor’s Note: We hope you have been enjoying our Robinhood #content. If you want to go deeper on this, make sure to check out Ranjan’s latest post, dismissing the lulz narrative of it all, and discussing the risks of it all. If you want to understand what the f gamma squeezes are, Ranjan also has you covered. Oh, he also once wrote about how Robinhood is a good way to lose money.

If you are fed up with Robinhood #content or Margins in general, I feel you.

There is no one single narrative that can cover what's happening. There literally can't be. The wall street bets subreddit has 4 MILLION members. Some of them are sticking it to wall street. Some are in it for the money. Some are bored, some are gamblers that can't help themselves.

All of this is irrelevant though, because the true value of what's happening is what it's revealing about wall street, the double standards, and the corruption of institutions that got us to this point.

2020 was eye opening in the same way re: institutional failure to handle the pandemic and racism, and 2021 is already shaping up to be just as tumultuous. We haven't even closed the first month of 2021, and the US capitol has already been stormed and wall street has been sent scrambling and begging for the sorts of regulations they stripped out decades ago because the people they've been screwing over for so long have turned the tables on them.

Question - is there any way to know who is behind the activity?

In this post, you link to a table of GameStock institutional ownership (totals 52M), but isn't the story a bit more nuanced than that: won't it depend on how much of that ownership is being floated and the mandate of those institutional investors?

Haven't seen much written about the dynamics of the different types of players in the ecosystem (e.g., could an ETF be taking bets? could an index fund? what actions are mandated in this case from its fiduciary duty?)