Bitcoin and Buying Things

Here's to the risk managers, not the risk takers.

Ranjan here. Margins has been quiet for a bit as Can and my day-jobs have been pretty intense, but hey, it's free! Today, I am going to try to outline the one central thing about cryptocurrencies that has always puzzled me: Why does everyone want the price to go up?

As all great stories involve pizza, you might have heard about the guy that bought a $200 million pizza. In May 2010, Laszlo Hanyecz spent 10,000 BTC to buy some pizza but has no regrets. I bought some BTC for around $100 in the Summer of 2013. I sold most of it that winter for around $1000. Sure, I think about what could've been, but 10x on anything is amazing, and I try to avoid imagining what could’ve been. But it’s hard to not occasionally and make those mental calculations.

When I first learned about BTC, I was incredibly hopeful. As a former currency trader, I was a direct beneficiary of the inefficiencies of cross-border money transfers and saw firsthand how massive markets that moved trillions of dollars often felt held together by duct tape. In emerging market derivatives, there would be crazy things like a new government coming in and nullifying existing contracts and lawyers on both sides spending a lot of time and money to resolve them. There had to be a better way.

In the summer of 2013 I went to some crypto meetups expecting to find some monetary utopians, but mostly encountered just a variant of the Wall Street trader personality. Which is fine - some portion of our financial system requires that swashbuckling component to make markets and discover prices. But if I had wanted to stick around that personality, I would've just stayed a bank trader and made a lot of money much more predictably.

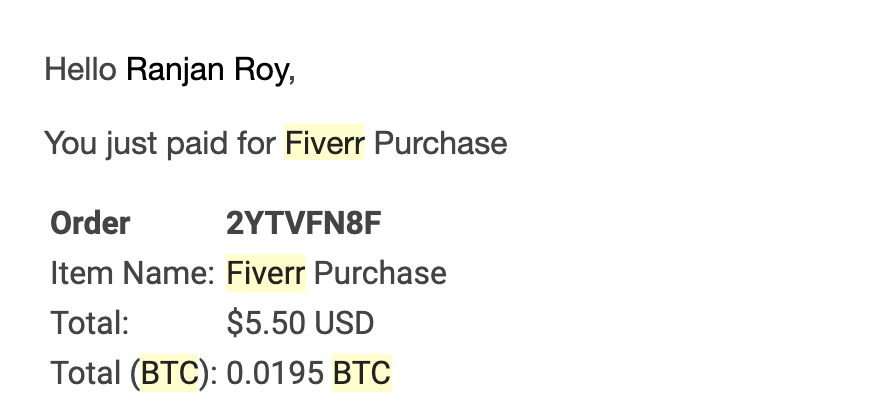

But I kept reading and watching. My small-scale "$200 million pizza" equivalent was when I paid someone about $5 on Fiverr from some residual BTC to draw a cartoon of my then-girlfriend, now wife, from a photo as a cutesy gift. It cost .0195 BTC, which would now be about $1,000.

It’s tiny, but every time there’s another price spike, I calculate what that cartoon thing had cost me.

Money

A functional monetary unit should have two things going for it (if you’re familiar with this stuff, this will be boring):

Medium of Exchange - you should be able to use money to buy things. People need to be willing to accept your currency in exchange for goods or services. For them to accept it, they need to believe others will also accept it. The self-fulfilling nature of this component is pretty clear. There's some critical mass of people who need to believe your currency is usable.

Store of Value - This is the slightly murkier component. Nominally, it means that your currency won't lose value over time (will, at the least, keep pace with inflation). This is logical as if your currency loses too much value over time, people won't want to hold it, which lessens the chance that they'll use it because they'll always be trying to get rid of it.

Hyperinflation is a clear, visceral reminder of how these two components feed off each other. As money rapidly loses its store of value, people are less willing to transact in it, which further depreciates the monetary unit, and down we go. Hitler.

There's a bit of grey space between what's a currency and what's an asset. Gold is a good example - at some historical point, it was used more regularly as a medium of exchange. Maybe there are still transactions involving briefcases full of gold, but it's evolved more as an asset that serves as a store of value instead of a currency. We all agree there is some intrinsic value to gold so it ends up holding value.

When I first heard about BTC, it seemed like it’d easily become a revolutionary medium of exchange. Like Craigslist and classifieds, or any other utopian internetification of industry economics, all the extractive profits derived by monetary middlemen would disappear. I’d be able to travel around the world and pay in BTC, bypassing exorbitant currency exchange and ATM fees. Maybe it wouldn't replace nationalized currency systems, but it would provide a much better alternative for a lot of day-to-day transactions.

That hasn’t happened yet. Will it ever?

BAT

Regular readers will know that I attribute attention-based digital advertising to a lot of the problems in the world.

When I first heard about the Brave Browser it almost felt religious. An all-star team was going to solve the problems of digital advertising using a digital currency called BAT, the Basic Attention Token. I read the whitepaper and was absolutely giddy. Imagine, instead of a bunch of opaque ad-tech companies securitizing and chopping up your attention into a million different auctions and transactions, everything became much cleaner, more direct, more transparent, and instantaneous.

The basic premise from Brave:

When you join Brave Rewards, your browser will automatically start tallying (only on your device’s local storage) the attention you spend on sites you visit. Once a month, Brave Rewards will send the corresponding amount of BAT, divided up based on your attention, from your local browser-based wallet to the sites you’ve visited. You can remove sites you don’t want to support, and tip creators directly too.

even cooler, you can even be paid for by advertisers for your attention:

You can control every aspect of Brave Ads — from the number of system notifications you’d like to see, to whether or not you want to hide sponsored images. You’ll earn 70% of the ad revenue that we receive from advertisers. In exchange for your attention, you’ll accumulate tokens as you browse. You can contribute these tokens to the sites you love — with more options coming later.

It's an almost utopian attention monetization ecosystem.

I bought some BAT after their ICO (remember those?) and was ready to save the world. But, I just ended up watching the price of BAT all day. I was wary of donating any of my BAT to publishers because what if this turned into some BTC or ETH type thing where I lost out on becoming insanely rich.

So the BAT is just sitting there. It's up about 5x as I write this. I never used it to save digital advertising.

Prices

Which brings me to the thing that still confuses me: Shouldn't the whole crypto community not be rooting for prices to keep skyrocketing?

Astounding price appreciation is a death knell for becoming a medium of exchange. As long as people care about the price they’ll never engage with the utility. But the catch-22 is the price appreciation is all predicated on these digital things one-day becoming mediums of exchange. The promise is in the utility. But as long as the entire focus of the ecosystem is on price appreciation and the corresponding wealth, how would we ever get to that world?

I'm genuinely curious and confused about this. Wouldn’t the ideal scenario be one where BTC and other digital currencies rose in a slow, stable manner, slightly outpacing inflation? Everyone would start paying for more things in BTC. I’d sign a smart contract lease that withdrew a pre-set amount of ETH each month. For my first post-pandemic vacation I’d travel to another country and pay for things out of my BTC wallet.

But as long prices keep going to the moon, you’d have to be out of your mind to ever actually use any digital currency.

There are more and more headlines about Paypal, Mastercard, and others who control the rails starting to support crypto. When the companies that compose our payment rails are getting on board, it seems like finally, that will mean more people buying stuff with crypto.

Yet, when you look at Paypal’s Terms and Conditions:

As described in more detail below, here are some things you can do with the Cryptocurrencies Hub:

Buy Crypto Assets;

Hold Crypto Assets;

Sell Crypto Assets; and

View market information and educational content.

You currently are NOT able to send Crypto Assets to family or friends, use Crypto Assets to pay for goods or services, or withdraw Crypto Assets from your Cryptocurrencies Hub to an external cryptocurrency wallet. If you want to withdraw the value from your Cryptocurrencies Hub you will need to sell your Crypto Assets and withdraw the cash proceeds from their sale.

Even Square “made nearly half of its Q4 revenue from its bitcoin-enabled Cash App”. The companies that were built at their core to facilitate payments for things are shifting strategy to profitably onboard new speculators. I guess at some point the thesis is that people will start using the BTC in their accounts to transact? But it seems like the exact wrong population was brought in to ever achieve this end goal.

Risk

A lot of my work in trading was to help corporate clients with FX hedging through derivatives - stuff like helping the client enter a contract to buy Thai Baht one year from now at an agreed price so that corporate treasurer could worry less about currency fluctuations. The purpose was de-risking.

One time we screwed up a hedge and the client accidentally made a ton of money. I made the mistake of congratulating them and got absolutely reamed. They told me that their boss would be pissed - well, they'd be "pissed". Everyone down the chain would have to make a show of acting disappointed. The point of all these corporate treasury transactions was to remove risk so their financial results would reflect the state of their actual business. They were widget-makers, not currency traders, and inadvertently making a lot of money meant they could just as easily have lost a lot of money. My job was to take risk. Their job was to minimize it.

As a core function of a corporate treasury, I'm absolutely baffled by Tesla’s purchase of BTC. Okay, I'm not really baffled because it's Elon and TSLA, so, you know, but it perfectly captures how everything with crypto is about risk-taking rather than risk management. It’s about speculation, not utility.

What would the crypto world look like if it was the risk managers running it rather than the risk-takers? Would crypto-companies be celebrating gross merchandise values of BTC transactions rather than the price? I imagine that some underlying technology of some digital currency will at some point improve the way we use money, I really want to believe but I also wonder if there have ever been incredible technologies that were just grifted out of existence?

I almost sympathize with the sheer ferocity of the crypto-pumping. If your power and wealth are directly tied to the price and that price increases under the promise of mass adoption, and you have mass influence, then, of course, you're going to do it. But shouldn’t price stability be the goal rather than appreciation? Otherwise, how do we ever moves past digital currency as a tradeable asset to something of utility? Obviously, that takes the fun out of all this, but isn’t money not supposed to be fun, but useful?

Note 1: I’m pretty fascinated by the whole NFT space (a really good piece from Scott Belsky on it). Probably the only time I ever “used” something crypto-based that made complete sense was in a World Cup 2018 betting pool that I wrote about. Maybe these things are a start?

Note 2: A friend of mine deep into the crypto-world insists that DeFi is the real future. I am intrigued as prediction markets and stablecoins seem like they could play a role. But every time I start reading something, it feels like this tweet is following me:

Note 3: One related point of confusion - if crypto never finds its everyday utility, then how do holders realize any of their wealth? If the end goal was is to just convert back to USD to take the profits and use the money to buy things, then it’d mean an inevitable collapse of the system. How do HODLers see the BTC-enabled future?

One minor clarification - Square making half its revenue from BTC Cash App is misleading; BTC transaction revenue is measured as gross value while currency-denominated transactions are measured as net. The proper comparison would be $4.6B gross/$97mm net revenue for BTC transactions measured against $103.7B gross/$3.3B net for other transactions.

This is already explained well, but to put it explicitly: an increase in the real value of a currency is deflation. As long as the price of Bitcoin goes up faster than dollar inflation, i.e. as long as it's an appealing investment, it's unappealing as a means of exchange (deflationary spiral etc).