Popeyes & Private Equity

Chicken Sandwiches and Zero-Based Budgeting

Ranjan here, talking about fried chicken and 3G.

I have long been obsessed with fried chicken. For any of our readers that have ventured onto our About page, my co-host Can managed to sneak this in this fact. I think it really took hold while going to college in Atlanta (RIP Gladys Knight’s Chicken & Waffles), and when I moved to NYC in 2002, fried chicken hadn't quite become the hipster sensation that it would be. Popeyes was by far the best accessible chicken. I kind of believe fried chicken can save the world.

Popeyes has long been a guilty, frequent pleasure of mine. I try to limit it to 1x a month, and I certainly dabble in upmarket chicken (Momofuku had an incredible reservation-only fried chicken dinner back in the day). But for the fast stuff, Church's is good, Bojangles is very good, KFC is garbage, and Popeyes is the best.

Popeyes has forever been considered, let's say, downmarket, by most people I know. So it was a bit jarring to see my Twitter feed lit up with Popeye's chatter this week.

There is a certain part of me that has that "I liked that band before they got big" hostility towards all this Popeyes talk, but I just had to write about this. The story has everything. The costs and benefits of private equity to society. Viral, conflict-based social media marketing. And of course, chicken.

Private Equity & Chicken

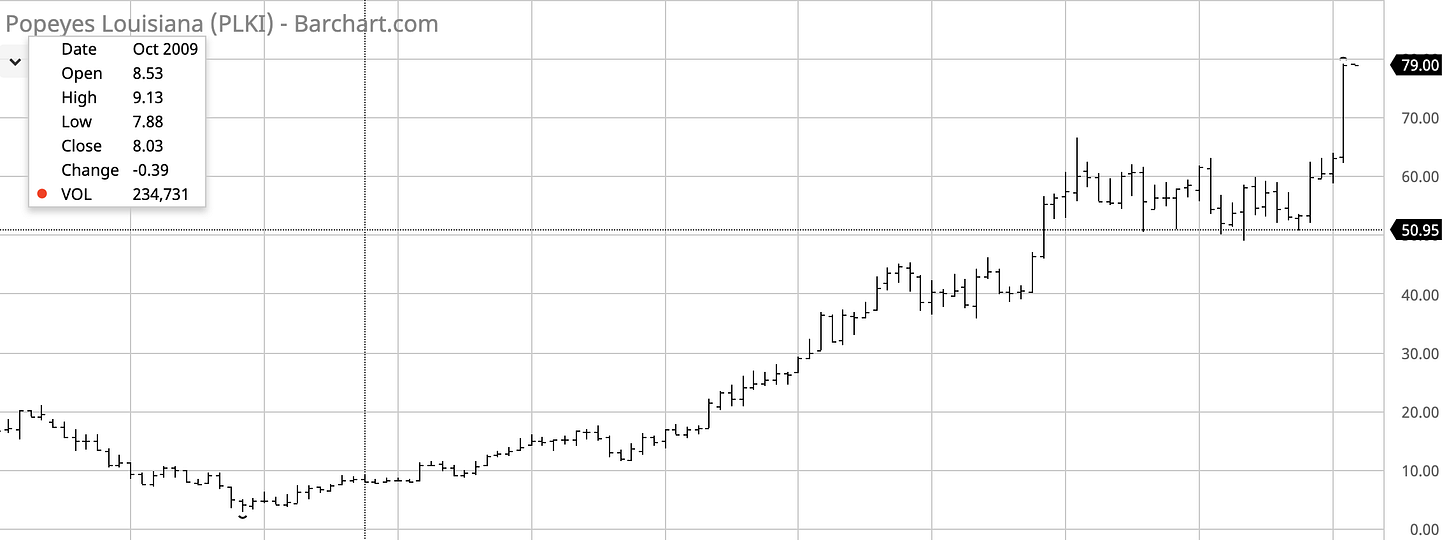

Let's first talk a little about the recent corporate history of Popeyes. Its parent company, called America's Favorite Chicken (AFC), went public in 2001. At some point they changed their ticker to PLKI. I remember looking at the stock chart in the early 2010s.

One cardinal rule of investing is to never regret the money you didn't make, but I still regret not buying PLKI, because I might've gotten rich off of chicken. Just imagine the dinner party conversations. The stock steadily climbed through the past decade, and then a company called Restaurant Brands International (RBI) bought them out in 2017.

GOOD PE

RBI is a really interesting company. It began with a famous Brazilian private equity firm called 3G Capital. 3G is kind of what you picture with a PE firm. Tall guys, good hair, nice suits. The founder played at Wimbledon and Bloomberg called him "the world's most interesting billionaire". They also embody the controversial stuff. They're most famous for intense cost-cutting efforts, debt-fueled dealmaking, mass layoffs, and a practice called zero-based budgeting. Again, it's pretty much exactly what you would picture with Private Equity.

Their first really famous deal was a $52 billion hostile takeover of Anheuser-Busch in 2008. This 2010 CNBC piece captures a lot of that drama. As far as PE takeovers go, this one seems to have generally worked out. All the good things you might hear about PE seemed to kick in. Trimming a bloated organization, sharing knowledge across multiple companies, growing top-line revenue and increasing profit margins. Synergies!

Their next big thing was taking over Burger King for $4 billion in 2010. Furthering the notion of private equity stereotypes, a 32-year old 3G guy was named CEO of Burger King in 2013. He checked all the boxes: Cornell grad, Wall Street, "tall and lanky", hard-working, etc. And again, with this one, 3G did incredibly well. Even McDonald's seemed to copy a number of their strategies over the past few years. BK worked so well, that they spun it out as a new, publicly-traded company called Restaurant Brands International. They bought Tim Horton's in 2014, and then, Popeyes, in 2017.

BAD PE

Then there is Kraft-Heinz. This is an incredible story. In 2013, 3G, alongside Warren Buffett, bought Heinz. In 2015, they merged it with Kraft Foods to create a consumer goods giant where they could apply all those classic PE principles. Right away, they laid off 5% of the workforce. There are some funny anecdotal things like cutting of free string cheese sticks and making sure everyone prints only in double-sided black ink.

This WSJ writeup (also this Pitchbook writeup) does a good job summarizing the debacle, and it was bad. After laying off thousands, the combined company is worth less than when they began. It looks obvious in hindsight. Getting a bunch of boxed macaroni with powdered cheese, hot dogs, and Jello brands that had been around for 50 years might've seemed like a tremendous asset, but in this era, they were a liability. You could not cost-cut your way to new consumer brands. The 3G founder even called himself "a terrified dinosaur" because of how rapidly the consumer goods landscape was changing.

Also, complicating 3G's path to PE greatness with Kraft-Heinz was a failed takeover bid of Unilever. Once again, the playbook was similar. Use their $50 billion consumer goods company and debt to facilitate a takeover of a much larger, older, "lazy", conglomerate. The story of how Unilever CEO Paul Polman fought off the takeover is the stuff of business legend. This FT piece gave the Succession-esque play-by-play and there was even an HBS case study on it called The Battle for the Soul of Capitalism.

But most important for our readers to note, Paul Polman was talking about fighting shareholder short-termism with community and customer-oriented longer-termism, all the way back in 2017.

“Do you want short-term forces – that work for a few people, and make a few more billionaires – to be the dominant force? Or do you want the system to work for the billions that need to be served? It’s a fundamental choice.”

In light of this week's big Business Roundtable announcement, where 181 CEOs announced they will shift from a shareholder-first to a stakeholder capitalism doctrine, I would love to see someone like Paul Polman leading these efforts.

THAT SANDWICH

Okay, back to chicken. Why did I spend so much valuable newsletter real-estate on the 3G? Well, it's a great business story you should dig into, but more relevant, we have to remember Popeyes is owned by RBI which is basically 3G. Popeyes is PE.

The infamous Popeyes chicken sandwich, called their “biggest product launch in 30 years” only became available on August 12th. But as my feed became increasingly dominated by chicken sandwich talk, I couldn't shake the feeling that I had already tried the sandwich before.

I went through my credit card statement and found it. July 9th, a charge for $4.34, which was $3.99 + NY tax, the price of the sandwich.

I remembered it. I was teaching a summer course at the CUNY Journalism School, and there is a Popeyes across the street. I’ve tweeted about the dangerous proximity of CUNY and a Popeyes as far back as January 2013 (and yes, I ate there twice that week).

I was able to confirm that the sandwich was around long before the official launch with a simple Twitter search. People had been tweeting about the sandwich for months. I started seeing mentions of the spicy chicken sandwich in mid-October 2018.

Which made me think more about just how brilliant this entire campaign has been. It was a quiet release over many months. They kept tweaking the product. A lot of those early tweets were about how it’s better than Chick-fil-a's sandwich, so you can start to see a marketing campaign forming.

But what I really want to know is how did they get everyone talking about it?

They certainly nailed the conflict-based social media marketing aspect of it. They went right after Chick-fil-A and Wendy's.

Nothing travels better and faster on algorithmic media than shade, conflict and competition. But was that it? Did they get lucky, or was this a genius, year-in-the-making, 3G special? Was the fried chicken brand beef accompanied by massive social ad spends? Did they hook in food influencers?

You have to remember, this is the same organization with the marketing geniuses that launched the Burger King - Andy Warhol Superbowl ad. They're also the ones that made the first major move into the vegan meat craze with the Impossible Whopper. They know how to make good noise.

I think I'm so intrigued by this because it could be an example of private equity at its best. Did 3G / RBI manage to bring this 50-year old brand, with an incredible product but probably not very well managed, to the national stage? Did they leverage a marketing knowledge base that has been built over a decade across two other massive brands (BK and Tim Hortons)?

Has my beloved Popeyes been given a new life thanks to private equity and that specific breed of hyper-capitalism?

I mean, the previous Popeyes management are the ones that came up with this concept of Rip'n Chikn - where it was an invention where you could "rip off" individual tenders, but ended up looking more like a weird, fried hand. Maybe, thanks to the synergistic magic of a fast-food conglomerate, we may never see something like this again.

Further Chicken Reading (mostly from my Instapaper):

Important note from Wikipedia: Alvin C. Copeland claimed he named the stores after the fictional detective Jimmy "Popeye" Doyle in the movie The French Connection and not the comic strip and cartoon character Popeye the Sailor. Also, there is no apostrophe in Popeyes.

Apparently, Popeyes is a guilty pleasure for both Anthony Bourdain and Danny Meyer

I love Fried Chicken and Geopolitics reading, and still remember this 2013 Guardian piece, The KFC smugglers of Gaza.

I had mentioned the story of KFC in China. This 2011 HBR piece outlines their strategy well (and this was long before the spinoff). And a weird connection to last week's piece, WeWork's global head of business and financial operations announced he was leaving this week, and his position prior to that was CFO of Yum Brands China.

Buzzfeed in 2015 on the real-life history of Colonel Sanders.

From me on Medium in 2013, trying to recreate the Popeyes recipe.

Not chicken-reading, but writing this post made me seriously business-crush on Paul Polman. Here is him talking about fending off the 3G takeover bid.