Exasperated Exuberance

How's it all gonna end?

Ranjan here. Today I'll be writing on the current market mania and what comes next.

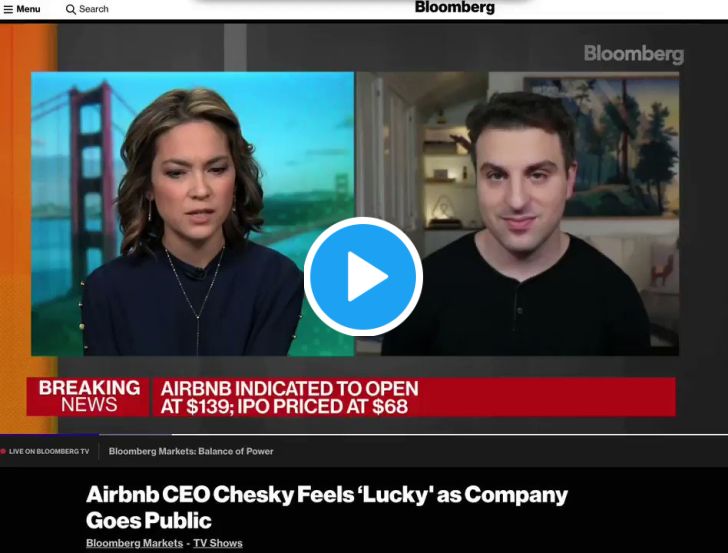

It was quite something to watch this moment:

Even Brian Chesky seems flummoxed. You can almost see him making a wealth calculation in his head, and full credit he handles it masterfully, but my god, what a crazy moment we’re in.

On Wednesday, I took part in a panel covering the Doordash S-1 + IPO, organized by Mario Gabriele (definitely check out his publication The Generalist). There were a bunch of very smart people digging into the economics and future of DoorDash in a very analytical, rational way. It was a follow-up to a written analysis you can read here.

The stock had just started trading so someone asked to pull up a live chart. We all sat there - talking about TAMs and AOVs and GMVs and acquisition targets like everything was normal. I had this weird moment where it just felt like we'd look back at this years later as a time capsule of the mania. One where we were all sitting there, blissfully backward-calculating into insane valuations, engaged in a collective, bubbly dissonance.

We would've had that exact same discussion if it IPO'd at the originally indicated $30 billion market cap. No one was trying to explain how the company, last privately valued a $16 billion company, had nearly quadrupled in value, with nothing new, other than a fairly solid financial disclosure.

Everyone went along having a thoughtful, rational discussion because that's all you can do. Even a few minutes earlier, a CNBC analyst was saying something to the tune of "the valuation is crazy but what are you going to do, not be in these names?".

WEIRD

Things have gone beyond not quite making sense to just being... a bit weird. But, what are you going to do, not be in these names? If you're a money manager, both emotionally and professionally, not being in these names is a bad look. Every Tiger fund manager is about to buy a yacht. Look out Austin and Miami real estate. Buy Now Pay Later is all the rage. I could go on and on, but I think we’re all feeling the mania.

I have a running joke with an investor friend of mine, whose returns would be near-astronomical in any other environment, yet is miserable because, on a relative basis to everyone loaded up on the same names everyone else is in, he's not doing great.

2021

That's the thing I can't stop wondering - where the hell does this all go in 2021?

If you asked me 1-2 years ago, I would've confidently proclaimed, it's a bubble and it'll obviously pop. And I would’ve been wildly wrong, but as a writer on Substack, I would somehow retain the undying confidence in my position. But 2020 has been such a strange year that I’ll be the first to say I have absolutely no clue how this plays out.

The CAPE Ratio is above its September 1929 level, and only lower than December 1999. Tobin's Q Ratio (which I just discovered from this FT piece) is at the same level only seen in January 2000. I'm sure there are plenty of other ratios and metrics showing mania, but what could possibly stop it?

Corporate profits have rebounded. Corporations are sitting on unprecedented amounts of cash. Home prices are skyrocketing (this other FT piece is quite good on these). The vaccine is around the corner, Biden is entering a divided government, and taxes and rates will likely not increase anytime soon.

Meanwhile, we're hitting record COVID deaths, millions of Americans are unemployed and over $5,000 behind on rent, and even shoplifting food and other essential products. The same day as AirBnB’s blowout, the new jobless claims number was terrible. But I’d guess every Margins reader is well aware of these K-shaped dynamics, otherwise, you would’ve already unsubscribed.

So what happens next?

The thing I can't stop thinking about is - in the status quo, nothing will change. The Fed can keep rates low because there's low inflation. There’s low inflation given the lower-half of earners, the ones who would spend money on goods and services and get paid in wages, are getting crushed. Asset price inflation is not factored in. House prices aren't factored into inflationary calculations, while rent is. Income inequality is disinflationary (or perhaps, more accurately, not inflationary) based on the way we measure inflation.

So the Fed will naturally keep rates low, meaning money will keep finding a way into the weirdest corners of the asset world. Prices will keep rising. Jerome Powell will continue insisting that we have to supplement monetary policy with robust fiscal policy, but the GOP will not be interested in stimulus because the stock market is up. Some #econtwitter guy will reply to this saying I'm not accounting for some esoteric correlation between the US Dollar and/or monetary velocity and am an idiot. Investors will pile into the next "company enabling the post-COVID economy". Rinse. Repeat.

Bull Case?

There is nothing about the current economic dynamics that would suggest any potential change. It seems like a best-case scenario that there is some post-vaccine level of stabilization in widespread employment - that the jobless finally find some kind of jobs, and start trying to once again find stability. The economy gets back on track in terms of real GDP and maybe we enter a Roaring 20s part 2?

But what happens to all those valuations? I’ve long been bullish on companies like Shopify, but can you really buy at these prices? Snowflake was an exciting company, but being valued at 100x revenues? Every one of these companies has been priced to perfection, on execution, strategy, and at a macro-level. Do they keep growing? Do the prices keep growing?

What happens to big tech? The Facebook FTC lawsuit is clearly going to shake things up, but do they all continue their dominance?

And of course, what about all the economic issues that plagued us pre-COVID? Inequality, even in a bull case, is going to be exacerbated as a lot of people just increased their wealth by a whole lot, while everyone else will just be once again stabilizing at best. Even in the best-case scenario, this is still a major issue, but what can possibly change things?

Even sitting on a trading floor in 2007/08 I never felt 'mania' in this way. Maybe if I was flipping houses in Miami I would've felt it more, but otherwise, outside of friends in finance, everyone else and everything else seemed...kind of normal at the time.

Exasperated Exuberance

My first internship was at a tech startup in the summer of 2000. It was called 3Plex.com and was founded by two Harvard Business School students who raised a bunch of venture capital to disrupt the third-party logistics industry. I guess that might've been a bit more manic. I remember them offering me shares in lieu of wages, but I was financing most of my education and took the cash. That was the right call, but I was still so hyped about tech that I wanted to leave school to get a job at Digiscents, a company that was going to digitize smell.

But I was too young to really understand that what I was experiencing was somehow different than a normal time. I only understood that afterward.

Is this 1999? Is this something completely different?

To many friends, I've been a broken record over the past 2-3 years - that things were getting increasingly manic in the markets. I've been mostly proven wrong. You had your WeWorks, but SoftBank is up 70% this year. Things have kept chugging along.

This has been called “the most hated bubble” for years now. Dan Primack recently called it the Forever Tech Bubble.

For me, the weirdest part about this is people don’t seem happy and excited like you might expect in a flood of wealth. My co-host Can insists everyone in late-stage SF tech is genuinely excited to watch these DASH and ABNB valuations and are calculating potential wealth scenarios based on their own company valuations. But why do the people cashing in seem mad? Bill Gurley’s mad at the bankers. VCs are mad at SF. Musk is mad at everyone. Is it all just an act, somehow in solidarity with the 80-85% not taking part, but behind the scenes, there’s plenty of champagne? If Greenspan gave us irrational exuberance, this feels like exasperated exuberance.

For the old hats, is this what 1999 felt like, or was there more excitement at the time? Is it just the backdrop of COVID that’s muted the widespread joy of wealth accumulation?

As someone who takes a few hours out of their week to prognosticate on things in a newsletter, I try to have a viewpoint. I can genuinely say, this is the first time in a long time, where the mania has hit such a point, that I am genuinely lost as to what might happen next. The dynamics driving this bubble are not set to change at any time in the near future.

How do others feel about the current state of things? Where do things go? Am I the only exasperated one? Buy or Sell? How does this all end?

The exasperation or madness/anger you speak of has its analog in China, where I was for six years. Here is an excerpt from an article I was reading just now, followed by the link:

"For my money, however, the most important motivating factor behind the embrace of the country’s socialist period is that young Chinese have lived and suffered under capitalism. Their recognition of and appreciation for the CCP’s early socialism-building achievements is underpinned by a broader reappraisal of the history and theory of the international socialist movement since the 19th century.

This reappraisal goes deeper than reproducing zombie narratives or 20th century rhetoric: It’s based on a vivid sense of contemporary life and reality. Young Chinese have spent much of their lives watching the decay of the global capitalist order, the rise of inequality, and the collapse of working class status. The earlier generation embraced pure market ideology, private enterprise, and capitalism, but to many young Chinese who work in the private sector their elders built, these ideas are associated not with unleashing productivity, but the droning pressure of “involution,” feelings of relative deprivation, and grueling work schedules like the 9 a.m. to 9 p.m., six-day-a-week marathon known as “996.”

Indeed, almost anywhere you look online, there’s a palpable sense of anger and frustration at capitalism and market ideology."

http://www.sixthtone.com/news/1006523/Fed%20Up%20With%20Capitalism,%20Young%20Chinese%20Brush%20Up%20on%20%E2%80%98Das%20Kapital%E2%80%99/

The purchasing of yachts you somewhat satirically you refer to -- and a fitting image for a much wider and deeper problem -- will produce little more than the dissatisfaction written about here.

Really enjoyed the panel discussion. Well done. https://www.stream.club/recordings/2ab9c855-d366-483d-a9a4-6cb85f6544bf